全球智能手表的孿生發(fā)展,激發(fā)國內外主控芯片廠(chǎng)商的戰斗力。

據潮電智庫統計,2022年全球智能手表的出貨量為2.28億只,同比增長(cháng)了12%。

潮電智庫認為,在過(guò)去長(cháng)達一年的激烈角逐,2023年全球智能手表主控芯片廠(chǎng)商的綜合競爭力已公布于眾,其出貨量排名前十的企業(yè)分別有蘋(píng)果、瑞昱、匯頂、紫光展銳、Nordic、三星、Ambiq、華為麒麟、昂瑞微和高通。

下面將從出貨量、市場(chǎng)份額、產(chǎn)品結構、主要客戶(hù)群體等綜合競爭力的四大關(guān)鍵要素展開(kāi)綜述。

當供應鏈正常運行時(shí),智能手表主控芯片出貨量越大,其市占率也有所增長(cháng),進(jìn)而反映企業(yè)對庫存、出貨量以及銷(xiāo)售量的布局實(shí)力。

值得注意的是,十大智能手表主控芯片廠(chǎng)商在2023年全球市場(chǎng)的競爭格局相對明顯。

從榜單上看,高端市場(chǎng)和中低端市場(chǎng)呈現兩極分化,各有王者,分別是蘋(píng)果和瑞昱,各自占有16%的市場(chǎng)份額。

“高端王者”是蘋(píng)果,主控芯片仍舊自研自用,出貨量排名第一,其市占率達16%。令人意外的是,瑞昱出貨量排名第二,其市占率與蘋(píng)果同樣持有16%。由此可見(jiàn),瑞昱在庫存、出貨量和銷(xiāo)售量等方面的協(xié)調關(guān)系有較大的跳躍,不過(guò)蘋(píng)果通過(guò)自研芯片所獲取的利潤總體上顯然比瑞昱高。

事實(shí)上,蘋(píng)果和瑞昱登上王者的寶座是有跡可循的。據潮電智庫統計,在2022年3月排行榜上,蘋(píng)果手表的主控芯片出貨量有245萬(wàn)顆,瑞昱為270萬(wàn)顆;在同年7月份,蘋(píng)果出了275萬(wàn)顆,瑞昱則出了250萬(wàn)顆。

目前來(lái)看,2022年蘋(píng)果和瑞昱的市占率合計為32%。與之相比,其他單個(gè)芯片廠(chǎng)商的市占率不高,僅是個(gè)位數。據潮電智庫統計,2022年匯頂、紫光展銳、Nordic、三星、Ambiq、華為麒麟、昂瑞微和高通的市占率分別是9%、7%、7%、7%、6%、5%、4%、4%。

整體上來(lái)看,蘋(píng)果在智能手表主控芯片的綜合競爭力“碾壓”眾多主控芯片廠(chǎng)商,拿下9.5分,而其他廠(chǎng)商的綜合實(shí)力則有較大的上升空間,急需調整未來(lái)發(fā)展的戰略思維,找準目標市場(chǎng),攻破技術(shù)難關(guān),提升競爭力。

產(chǎn)品結構細分為高端市場(chǎng)和低端市場(chǎng),主要區別在于品牌、技術(shù)和價(jià)格三方面。

從榜單來(lái)看,2023年全球智能手表主控芯片市場(chǎng)有五大“高端玩家”,分別是蘋(píng)果、三星、Ambiq、華為麒麟、高通,紫光展銳和Nordic在中高端市場(chǎng)顯然杰出有名,而瑞昱、匯頂則在中低端市場(chǎng)受到歡迎,而以白牌為主要客戶(hù)群體的企業(yè)獨有昂瑞微。

這五大“高端玩家”的來(lái)頭可不小,本身不僅有強大的品牌勢力,其主控芯片也有強硬的技術(shù)實(shí)力。

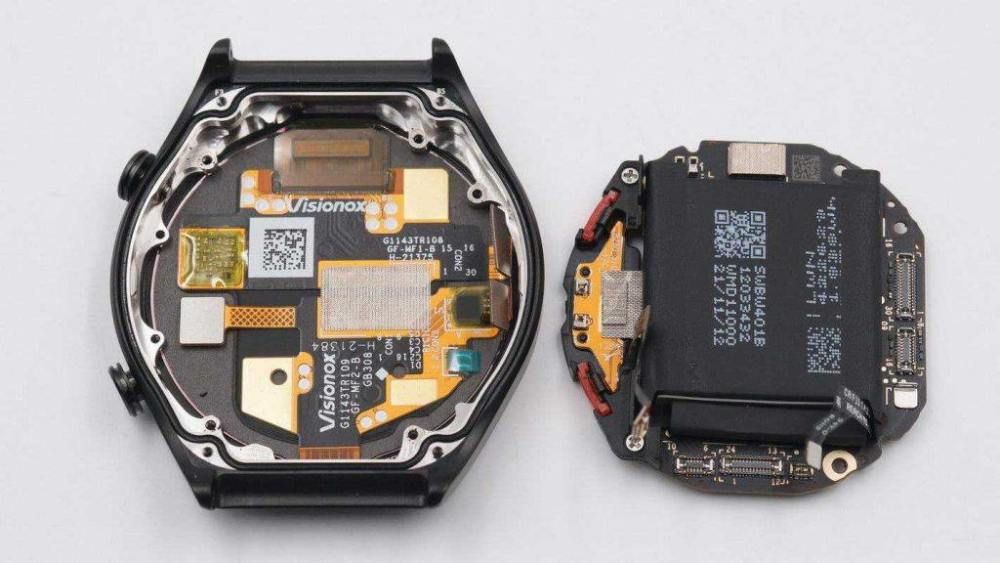

蘋(píng)果是美國芯片巨頭,Apple Watch選用自研的S7芯片,保證Apple Watch的Retina屏幕以60幀的流暢速度進(jìn)行刷新。高通在工藝上更精細化一些,其手表搭載的驍龍W5 Gen1和驍龍W5+Gen1芯片升級到最先進(jìn)的4nm制程工藝,比蘋(píng)果S7芯片減少3 nm。AmbiqMicro是美國一家物聯(lián)網(wǎng)芯片設計公司,其Apollo4 Plus和Apollo4 Blue Plus搭載了低功耗藍牙5.1射頻功能,擁有強勁的計算能力以及存儲能力,使得待機功耗最高可降低38倍。三星Galaxy Watch 4的主控芯片是自研的Exynos W920 5nm雙核處理器芯片華為麒麟A1芯片實(shí)現了4.3mm x 4.4mm的"小巧尺寸",可植入到任何小型可穿戴設備。

從中發(fā)現,蘋(píng)果、三星和華為麒麟皆走在自研自用的大道上,這或將是他們在智能手表主控芯片上的發(fā)展方向。

而瑞昱在品牌勢力和技術(shù)實(shí)力兩方面可謂是比上不足比下有余。瑞昱在2020年底推出了8762D系列,最高可以實(shí)現480*480以下分辨率的AMOLED屏的驅動(dòng),它的8762系列產(chǎn)品目前在藍牙運動(dòng)手表市場(chǎng)上占據重要地位。

匯頂和瑞昱兩家企業(yè)同臺競爭,局面相當激烈。從潮電智庫統計的出貨量來(lái)看,瑞昱在3月份出了270萬(wàn)顆主控芯片,而匯頂相對落后,僅出48萬(wàn)顆,但在7月,匯頂緊緊跟著(zhù)瑞昱的步伐,其芯片出貨量破兩百萬(wàn),不過(guò)瑞昱以250萬(wàn)顆出貨量勝出。

綜合來(lái)看,全球智能手表主控芯片市場(chǎng)將從中低端往高端發(fā)展,以白牌為主要客戶(hù)群體的獨有昂瑞微,其主控芯片的出貨量排名第九,市占率僅有4%。進(jìn)一步看,白牌主控芯片的市場(chǎng)空間將有可能被品牌擠兌,甚至被中、高端主控芯片所替代。因此,技術(shù)轉型和產(chǎn)品創(chuàng )新是未來(lái)智能手表主控芯片的兩大發(fā)展重點(diǎn) 。

主要客戶(hù)群是全球智能手表主控芯片綜合競爭力的重要指標,在中、高端市場(chǎng)當中,優(yōu)質(zhì)的客戶(hù)群將會(huì )帶來(lái)潛在而長(cháng)久的品牌聯(lián)動(dòng)效應。

不難發(fā)現的是,“高端玩家”的芯片玩法不是自研自用,就是服務(wù)大品牌客戶(hù)。目前來(lái)看,高通的主控芯片主要應用在華為、OPPO等國內知名品牌智能手表上,而Ambiq主要為小米、OPPO和佳明等大品牌商服務(wù)。

據潮電智庫統計,華為和蘋(píng)果在2022年全球智能手表品牌占主導地位,合計份額近31%,其中華為占有10%的市場(chǎng)份額。究其原因,華為HLOS智能手表出貨量在2022年翻了一番,推動(dòng)華為實(shí)現9%的同比增長(cháng)。此外,OPPO在 2022 年全球智能手表的市場(chǎng)份額增加到3%,實(shí)現了 105% 的同比增長(cháng),這得益于其新發(fā)布的 Watch 3 系列受到全球市場(chǎng)的青睞。

高通和Ambiq盡管出貨量不大,但下游客戶(hù)華為和OPPO在全球智能手表市場(chǎng)表現出色,成為其進(jìn)入前十的有力背書(shū)。

事實(shí)上,紫光展銳和Nordic在主控芯片中高端市場(chǎng)的表現相對平衡,兩者的芯片出貨量和市占率皆位居榜首前五。紫光展銳的客戶(hù)群體主要有小天才、華為和360等,而Nordic得主要客戶(hù)群體是愛(ài)都科技,相比之下,前者客戶(hù)群體比后者要大一些,其客戶(hù)群的品牌勢力也占優(yōu)勢。

龐大的客戶(hù)群在智能手表主控芯片的中、低端市場(chǎng)將會(huì )帶來(lái)長(cháng)尾效應。根據潮電智庫統計,含白牌在內,2022年印度智能手表總出貨量超過(guò)六千萬(wàn)只,其中品牌端同比增長(cháng)165%,并以22%的市占率超越北美成為全球最大智能手表市場(chǎng)。之所以瑞昱和匯頂出貨量排在前三,是因為他們把目標市場(chǎng)定位在印度地區,使其出貨量得到快速增長(cháng)。

瑞昱在智能手表芯片出貨量和市占率超越匯頂,主要得益于龐大客戶(hù)群的差異性以及合作客戶(hù)本有的品牌勢力。匯頂的合作客戶(hù)是Tata,而Tata是印度最大的的集團,其涉及的業(yè)務(wù)廣泛,但在智能手表主控芯片的投入相對較少。瑞昱與Noise、boAt兩家印度智能手表大品牌商合作,目前共占品牌市場(chǎng)份額超過(guò)七成,由此可見(jiàn),瑞昱的客戶(hù)群體比匯頂龐大而精準化。

小結綜上所述,十大全球智能手表主控芯片廠(chǎng)商的戰斗力十足,各顯神通而榜上有名。

潮電智庫預測,2023年和2024年全球智能手表的出貨量預計趨向增長(cháng),預估2023年同比增長(cháng)率為14%,到2024年出現最高的增長(cháng)點(diǎn),出貨量預估高達3.4億只,同比增長(cháng)率達到35%。而主控芯片出貨量將隨著(zhù)未來(lái)兩年智能手表市場(chǎng)規模的擴大而而有所增長(cháng)。

因此,各大主控芯片廠(chǎng)商在研發(fā)投入、目標市場(chǎng)和客戶(hù)群體等方面需要進(jìn)行精心布局,進(jìn)而更好捕捉智能手表市場(chǎng)的增長(cháng)點(diǎn)。

2023 Top 10 of Global Smartwatch Bluetooth master Chip companies

The development of global smart watches has stimulated the competitiveness of domestic and foreign master chip manufacturers.

According to Electrend, the global shipment volume of smart watches in 2022 was 228 million, an increase of 12% year-on-year.

Electrend believes that in the fierce competition that has lasted for a year, the comprehensive competitiveness of global smartwatch master chip manufacturers in 2023 has been announced to the public. The top ten companies in terms of shipment volume are Apple, Realtek, GOODIX, UNISOC, Nordic, Samsung, Ambiq, Huawei Qilin, Onmicro, and Qualcomm.

The following will provide an overview of the four key factors of comprehensive competitiveness, including shipment volume, market share, product structure, and main customer groups.

1、Shipping volume&market share

When the supply chain operates normally, the larger the shipment volume of smartwatch master chips, the more their market share also increases, which reflects the company's layout strength in inventory, shipment volume, and sales volume.

It is worth noting that the top ten smart watch master chip manufacturers have a relatively clear competitive landscape in the global market in 2023.

From the list, there is a polarization between the high-end market and the mid to low end market, with each havin its own king, namely Apple and Ruiyu, each holding 16% of the market share.

The 'king' is Apple, and the main control chip is still self-developed and used, ranking first in terms of shipment volume, with a market share of 16%. Surprisingly, Realtek ranks second in terms of shipment volume, with a market share of 16% similar to Apple's. From this, it can be seen that there has been a significant leap in the coordination relationship between Ruiyu in terms of inventory, shipment volume, and sales volume. However, overall, Apple's profits from self-developed chips are clearly higher than Realtek.

In fact, there are traces of Apple and Realtek ascending to the throne of kings. According to Electrend, in the March 2022 ranking, Apple Watch's main control chip shipment volume was 2.45 million, while Realtek had 2.7 million; In July of the same year, Apple produced 2.75 million, while Ruiyu produced 2.5 million.

At present, the total market share of Apple and Realtek in 2022 is 32%. Compared to other individual chip manufacturers, their market share is not high, only in single digits. According to Electrend, the market share of GOODIX, UNISOC, Nordic, Samsung, Ambiq, Huawei Kirin, Onmicro, and Qualcomm in 2022 were 9%, 7%, 7%, 7%, 6%, 5%, 4%, and 4%, respectively.

Overall, Apple has "crushed" numerous manufacturers of smart watch control chips in terms of overall competitiveness, scoring 9.5 points. However, other manufacturers have significant room for improvement in their overall strength, and there is an urgent need to adjust their strategic thinking for future development, identify target markets, overcome technical difficulties, and enhance competitiveness.

2、product mix

The product structure is divided into high-end and low-end markets, with the main difference being in brand, technology, and price.

From the list, there are five "high-end players" in the global smart watch control chip market in 2023, namely Apple, Samsung, Ambiq, Huawei Kirin, Qualcomm. UNISOC and Nordic are clearly outstanding and well-known in the mid to high end market, while Ruiyu and Huiding are popular in the mid to low end market, while companies with white cards as their main customer group are exclusive to Angruiwei.

These five "high-end players" have a considerable background, not only havin strong brand power, but also havin strong technical strength in their main control chips.

Apple is an American chip giant, and the Apple Watch uses its self-developed S7 chip to ensure that the Retina screen of the Apple Watch refreshes smoothly at 60 frames. Qualcomm is more refined in terms of technology, and its watches are equipped with Snapdragon W5 Gen1 and Snapdragon W5+Gen1 chips that have been upgraded to the most advanced 4nm process technology, which is 3 nm less than Apple S7 chips. Ambiq is a chip design company for the Internet of Things in the United States. Its Apollo 4 Plus and Apollo 4 Blue Plus are equipped with low-power Bluetooth 5.1 RF function, which has strong computing power and storage capacity, allowing standby power consumption to be reduced up to 38 times. The main control chip of the Samsung Galaxy Watch 4 is the self-developed Exynos W920 5nm dual core processor chip, the Huawei Kirin A1 chip, which achieves a "compact size" of 4.3mm x 4.4mm and can be implanted into any small wearable device.

It is found that Apple, Samsung, and Huawei Kirin are all on the path of self-developed and self used, which may be their development direction in the main control chip of smart watches.

However, Realtek's brand power and technical strength can be said to be insufficient compared to others. Ruiyu launched the 8762D series at the end of 2020, which can drive AMOLED screens with resolutions up to 480 * 480. Its 8762 series products currently occupy an important position in the Bluetooth sports watch market.

The competition between Huiding and Realtek on the same platform is quite fierce. According to the shipment volume calculated by Electrend, Realtek produced 2.7 million main control chips in March, while Huiding was relatively behind with only 480000. However, in July, Huiding closely followed Ruiyu's footsteps, with chip shipments exceeding 2 million. However, Realtek won with a shipment volume of 2.5 million.

Overall, the global smart watch master chip market will develop from the mid to low end to the high-end. The unique Onrywei, with white brand as the main customer group, ranks ninth in terms of master chip shipment volume and only has a market share of 4%. Furthermore, the market space for white brand main control chips may be squeezed by brands and even replaced by mid to high-end main control chips. Therefore, technological transformation and product innovation are the two major development priorities for future smart watch control chips.

3、Main customer groups

The main customer base is an important indicator of the comprehensive competitiveness of global smartwatch control chips. In the mid to high-end market, high-quality customer base will bring potential and long-term brand linkage effects.

It is not difficult to find that the chip gameplay of "high-end players" is either self-developed and self used, or serves large brand customers. At present, Qualcomm's main control chip is mainly used in domestic well-known brands such as Huawei and OPPO for smart watches, while Ambiq mainly serves major brands such as Xiaomi, OPPO, and Garmin.

According to Electrend, Huawei and Apple dominate the global smartwatch brands in 2022, with a total share of nearly 31%, with Huawei holding 10% of the market share. The reason for this is that Huawei's HLOS smartwatch shipments doubled in 2022, driving Huawei to achieve a 9% year-on-year growth. In addition, OPPO's global market share for smartwatches increased to 3% in 2022, achieving a year-on-year growth of 105%, thanks to its newly released Watch 3 series being favored by the global market.

Although Qualcomm and Ambiq have small shipments, downstream customers Huawei and OPPO have performed well in the global smartwatch market, becoming strong endorsements for them to enter the top ten.

In fact, the performance of UNISOC and Nordic in the high-end market of main control chips is relatively balanced, with both chip shipments and market share ranking in the top five. UNISOC's customer base mainly includes Okii, Huawei, and 360, while Nordic's main customer base is Aidu Technology. In contrast, the former has a larger customer base than the latter, and its brand power in the customer base also has an advantage.

The large customer base in the mid to low-end market of smart watch control chips will bring a long tail effect. According to the Electrend, the total shipment of smart watches in India, including white brands, exceeded 60 million in 2022, with a year-on-year increase of 165% in the brand end and surpassing North America with a market share of 22% to become the world's largest smart watch market. The reason why Realtek and GOODIX rank in the top three in terms of shipment volume is because they have positioned their target market in the Indian region, which has led to rapid growth in their shipment volume.

Realtek surpassed GOODIX in the shipment volume and market share of smart watch chips, mainly due to the differences in its large customer base and the inherent brand power of its cooperative customers. The cooperative client of GOODIX is Tata, which is the largest group in India and involves a wide range of businesses. However, the investment in smart watch control chips is relatively small. Realtek collaborates with two major Indian smartwatch brands, Noise and boAt, and currently holds over 70% of the brand's market share. This shows that Ruiyu's customer base is larger and more precise than Huiding's.

Summary

In summary, the top ten global smartwatch master chip manufacturers have strong combat capabilities, each exhibiting their unique abilities and making them on the list.

Electrend predicts that the global shipment volume of smart watches is expected to increase in 2023 and 2024, with an estimated year-on-year growth rate of 14% in 2023 and the highest growth point by 2024. The estimated shipment volume is as high as 340 million, with a year-on-year growth rate of 35%. The shipment volume of main control chips will increase with the expansion of the smart watch market in the next two years.

Therefore, major control chip manufacturers need to carefully layout their research and development investment, target markets, and customer groups in order to better capture the growth points of the smart watch market.